Facing criticism and mounting fiscal concerns, Gov. Shapiro proposed a tax on skill games, a policy that was quickly met with backlash.

Shapiro floated the idea for a tax on skill games in his most recent budget proposal. The Democratic Governor also pushed for the legalization of recreational marijuana and different energy taxes, elevating fiscal issues to a focal point for his administration in 2025.

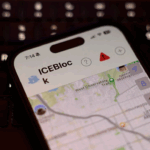

Skill games are common in bars, arcades and other venues, and Shapiro cited their lack of regulation to support his proposal. The budget set a goal of $360 million raised from regulation of the games.

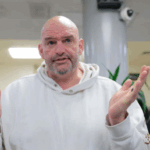

“There are 70,000 unregulated skill game terminals all across Pennsylvania,” said Governor Shapiro while addressing reporters on the state of the next budget last week. “We need to take some of the money going into those slots and put it in our state coffers.”

Shapiro was quickly met with opposition, led by Pennsylvania State Senator Gene Yaw, who criticized the feasibility of the 52% tax proposed by the Governor. A 52% rate is in line with state taxes on casino slot machines, making the two games regulated and taxed as equals. “At a 52% tax rate, they don’t have to worry about skill games,” the Republican State Senator said. “Nobody will put them out. No operator will. There’s no way that they can make a profit on them.”

Shapiro also floated different regulations for the games in addition to the tax, citing the lack of quality control for people who play the games as an issue to be addressed. The Governor also proposed that the state Gaming Control Board should have ultimate oversight of skill games, which have increased in popularity recently, but have long been controversial in Pennsylvania. Sen. Yaw opposed the proposed regulation and tax as well, saying the Department of Revenue should be in charge of oversight, and criticized the Gaming Control Board for being “too cozy” with casinos.

Yaw compared skill games to the current Pennsylvania lottery structure, which is housed and managed by the Department of Revenue. Kevin O’Toole, the Executive Director of the Pennsylvania Game Control Board, argued the PGCB is “the only agency in the commonwealth with ability and experience and knows how to regulate slot machine activity.”

According to Pace-O-Matic, the main developer of Pennsylvania’s skill game terminals, a 52% rate is unreasonable. The company supported a 16% tax and lowered the revenue generation projection to $250 million. Shapiro’s administration has not directly responded to Pace-O-Matic’s proposal, but was reportedly hopeful it could generate enough bipartisan support to begin crafting legislation in the coming months. Shapiro also cited local District Attorneys for their heavy support of regulating skill games, arguing the unregulated nature heavily interfered and undermined Pennsylvania’s lottery system and senior citizens.