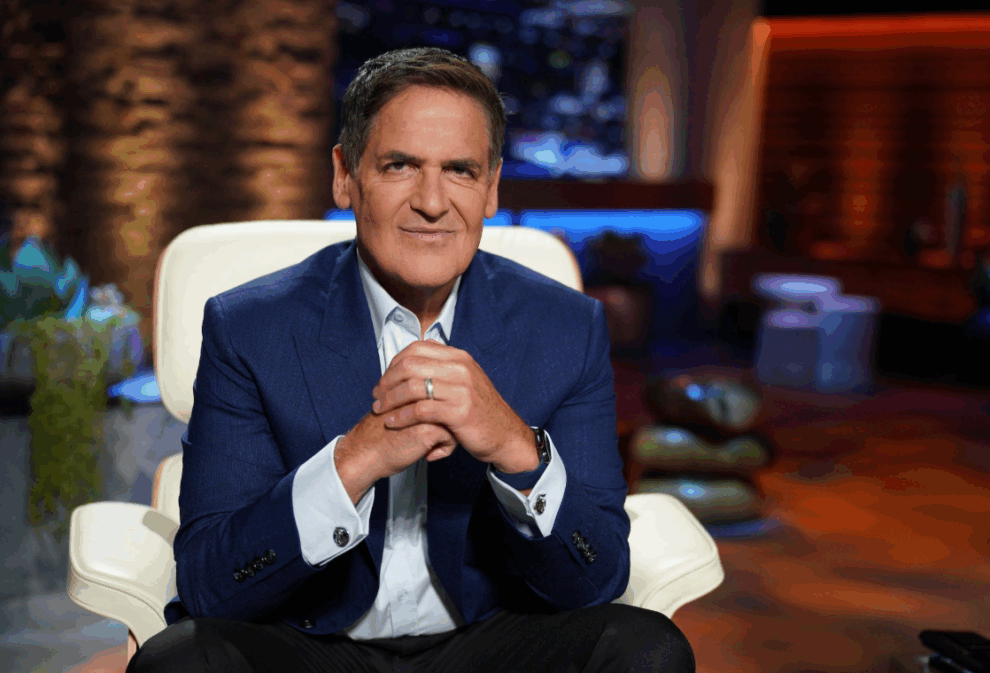

The Pittsburgh-native billionaire returned to his hometown for his latest business venture.

Mark Cuban and Giant Eagle announced a new partnership on Wednesday afternoon, focused on tackling prescription drug prices. The billionaire entrepreneur and Shark Tank investor was in Pittsburgh for his new business venture, Cost Plus Drugs Company. A spokesperson for the partnership said the goal was to not only raise awareness for the challenges of meeting prescription drug prices, but also to lower them by eliminating hidden fees and pharmacy benefit managers. Cuban’s Cost Plus Drugs Company serves as a direct-to-manufacturer negotiator for prescription drug prices, which reportedly helps eliminate intermediary costs.

“Unlike a lot of the industry, where they’ll mark it up to as much as they can charge, our markup is only 15%, which means our prices are a lot lower than people are used to getting,” said Cuban on Wednesday. “Giant Eagle is Pittsburgh and Pittsburgh is Giant Eagle.” Cuban is a Pittsburgh native and spent his first year of undergrad at University of Pittsburgh. It was Cuban’s first time back in his hometown for several years.

Giant Eagle CEO Bill Artman was on hand for the announcement, and touted Giant Eagle’s lack of markup pricing. Artman said that the company recently acquired six million new prescriptions, after Rite Aid Pharmacy filed for bankruptcy. Artman said some companies, including Rite Aid, could mark up by over 100% on certain prescription drugs. Artman and Cuban both listed transparency as the key behind the partnership and the most important element to lowering prescription drug prices for everyday Americans.

Giant Eagle is the latest company to work with Cost Plus Drugs Company, but has the potential to be the most impactful partnership. Cuban’s newest venture works by issuing a card called a Team Cuban Card and using an online app to locate the nearest stores participating. Cuban said that while the Team Cuban Card does not replace insurance, a pharmacist at a participating location will handle the rest. Cuban noted that not all prescription drugs are currently eligible for the reduced prices offered by Cost Plus.

Elaborating on the program, Cuban pointed to pharmacy benefit managers as a significant problem in the industry, where they currently act as intermediaries between drug companies and insurers, where they negotiate discounts and rebates based on the prices insurers pay and the revenue that pharmacies receive. The use of the intermediary often contributes to the heavy mark up price offered by pharmacies. Cuban’s Cost Plus reportedly eliminates that, and buys drugs directly from the manufacturer, or in some cases, produces them in-house.

“We’re trying to disrupt an industry that needs to be disrupted,” Cuban said on Wednesday. But Cuban’s efforts have not been applauded by some, specifically pharmacy benefit managers. They argue that they improve the efficiency of claims processing and ultimately lower drug costs through their leverage with manufacturers.

“Mr. Cuban’s repeated comments about PBMs are unfortunate and a wholly inaccurate representation of how pharmacy benefit services actually work and save money for businesses,” said Greg Lopes, a spokesman on behalf of benefit managers. Cuban did not respond to Lopes comments, but noted that Cost Plus would continue to add drugs to the program with Giant Eagle on board, and planned to expand an online service where consumers can purchase drugs directly through the Cost Plus website.