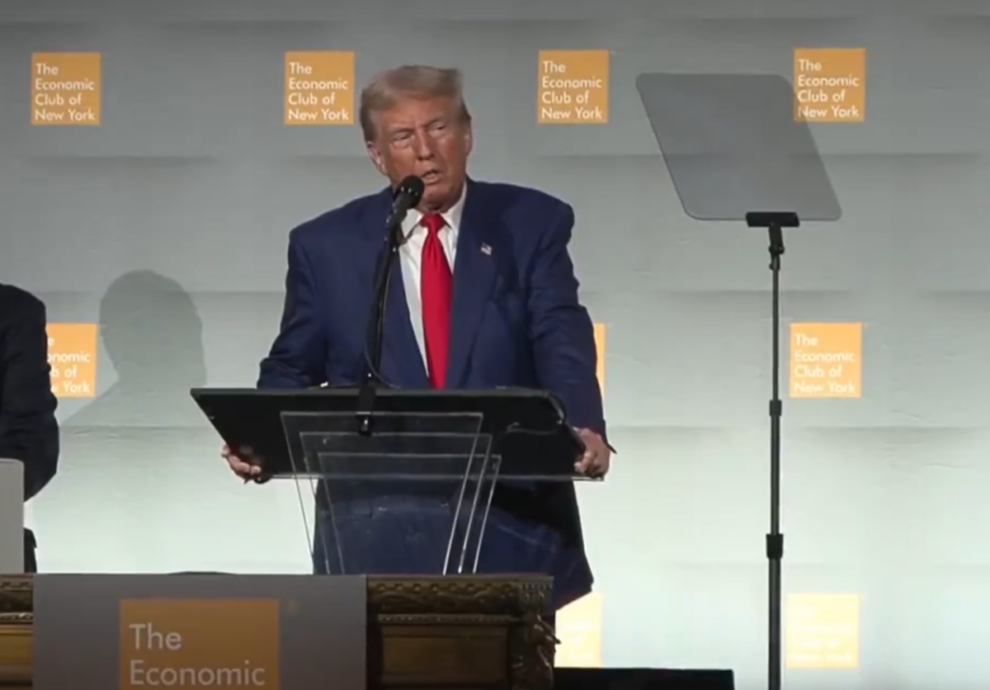

Former President Donald Trump has introduced a new tax plan designed to support the U.S. manufacturing sector. At a recent press conference, Trump outlined his strategy to provide tax incentives for domestic manufacturers, aiming to enhance their competitiveness and stimulate economic growth. He also vowed to undo numerous Biden administration moves. He called for extended tax cuts, deregulation and tariffs on companies who outsource jobs or import products.

The proposed plan includes various tax deductions and credits for manufacturers, with the goal of reducing operational costs and encouraging domestic investment. Trump emphasized that these changes are intended to make American companies more competitive internationally while also creating jobs within the U.S.

Donald Trump Tax Plan Ideas: Details & Analysishttps://t.co/1Wmu1IeZUZ #Debate2024 #DebateNight

— Tax Foundation (@TaxFoundation) September 11, 2024

“The objective of this tax plan is to strengthen American manufacturing by making it easier for our companies to thrive,” Trump said. “By lowering the tax burden, we hope to boost investment and job creation right here at home.”

The plan also features measures to simplify regulatory requirements, which proponents believe will further support the manufacturing sector’s growth. While the plan has garnered support from business leaders who view it as a step toward economic revitalization, it has also sparked a broader debate about its potential impact on the federal budget and overall economic policy.

Critics argue that while the tax incentives could benefit manufacturers, they may also lead to increased budget deficits if not accompanied by corresponding spending cuts or revenue increases. Supporters, however, contend that the long-term economic benefits will outweigh these concerns, highlighting the potential for job creation and increased investment in American industry.