Some decision making for Nippon Steel’s merger with U.S. Steel will be controlled by the U.S. government, according to Senator McCormick.

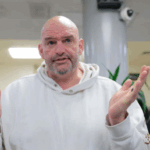

Sen. Dave McCormick (R-PA) said on Tuesday that the U.S. government will retain some veto and decision-making power over U.S. Steel as part of the proposed Nippon Steel takeover agreement. The deal has been touted by President Trump as a jolt of life to American-made manufacturing of steel in Pittsburgh, saying the agreement will add 70,000 jobs and over $14 billion to the economy. Sen. McCormick lauded it as a “strong partnership” and said the U.S. government would have say on board members, production levels and decisions on steel output.

Nippon Steel’s longstanding interest in a complete takeover of the U.S. steel market, which is centered around Pittsburgh, was denied by both President Trump and President Biden, citing potential national security concerns and threats to the region’s blue-collar workers. Nippon Steel first sought a merger with U.S. Steel in December 2023. President Biden initially blocked the merger on January 3rd, 2025, less than three weeks before the end of his presidency. President Trump, who received an updated proposal in April, told reporters that the new deal between the two companies will ensure production remains in the U.S., while still enhancing Nippon’s funding in the U.S. steel market.

Sen. McCormick said the deal also ensures that the company will remain in the hands of an American CEO. McCormick called the exact share the U.S. government would hold over the company as a “golden share” but suggested that the agreement was initially proposed by Nippon. Its board of directors has yet to officially comment on the specifics that McCormick and Trump have brought to light. The deal would put an additional $14 billion into the steel market, according to McCormick.

As part of the $14 billion investment, Nippon will oversee the production of a new electric arc furnace, a high-end new type of electric steel mill that melts down scraps. Pennsylvania State Sen. Kim Ward championed the proposed updated merger and valued the deal at close to $28 billion. “This is so huge for us and for our region,” Sen. Kim said. “It is security for a long time in Pittsburgh, in the southwestern part of the state.” The agreement will also direct over $2 billion directly to Pittsburgh-area steel production centers.

The U.S. Steel stock price jumped about 2% on Tuesday after details of the initial agreement were revealed to a close of $53.04 per share. According to CNBC, Nippon’s merger values the U.S. Steel stock at roughly $55.00 per share. Once Nippon countered the rejected merger agreement with increased focus on U.S. investment, President Trump ordered a new review of the acquisition. The president had said he would only sign the deal if it ensured that all production would remain “in the U.S.A.”

President Trump discussed the blocked merger, as well as a path forward, with Japanese Prime Minister Shigeru Ishiba at the White House in February. The Prime Minister reiterated that Nippon’s interest was in the U.S. market, while President Trump maintained that Pittsburgh would need to retain full control. Under the new agreement, Nippon still reaches the U.S. marketplace to a greater extent than before but must also reach the investment thresholds agreed to by President Trump.